Construction is widely recognized as one of the most high-risk industries in the world, and the company (or companies) facilitating construction on a project often takes on the most risk.

Typically, the owner or general contractor (GC) on the project must ensure that all parties working on the project have adequate insurance coverage. If/when an accident occurs on a site, someone is always liable.

Liability is not always easy to determine and if the party or parties (the GC, the owner, or both) managing the project do not ensure adequate insurance coverage on the project, the liability associated with an accident will fall on whoever is managing the job.

So why do general contractors and owners take on so much risk? High-Risk = High-Reward.

Although construction is high risk, world-class contractors have ensured various checks and balances to ensure that a project runs smoothly. Many have built very profitable companies by ensuring risk is properly managed and mitigated. These world-class companies not only prevent the likelihood of an accident occurring, but they are well prepared on the insurance front if something is to occur on-site.

Table of Contents (Click to Jump to Section)

The 2 Types of Project Insurance Models on a Construction Project

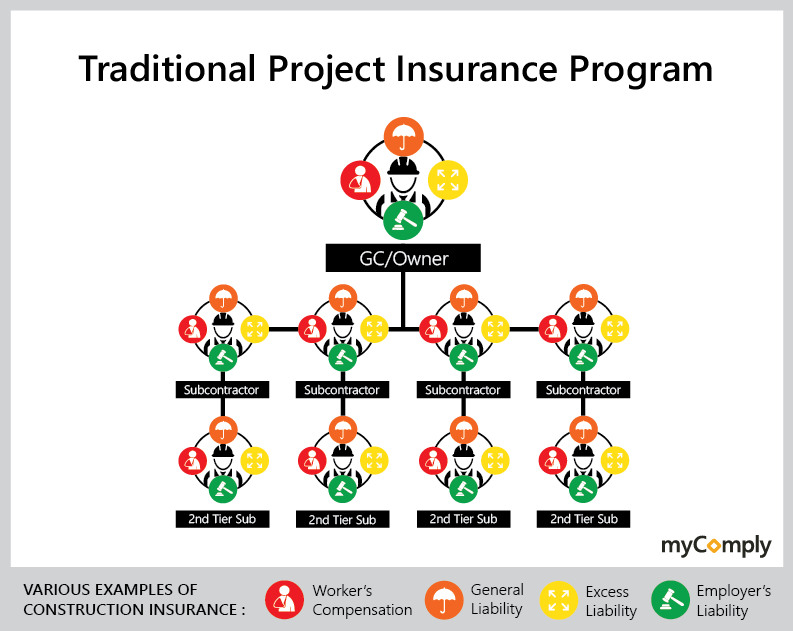

There are two ways that general contractors and owners ensure all groups involved on a project have adequate insurance coverage:

- Traditional Insurance Model

- Wrap-Up Insurance Model

In this article, we look to explore both the traditional insurance model in construction as well as the wrap-up model and explore the differences between both models.

By the end of this article, you should not only have a good understanding of the two options, but you should also understand which model suits your next construction project.

Examples of Construction Insurance

- Worker’s Compensation

- General Liability

- Excess Liability

- Employer’s Liability

What is a Traditional Insurance Program in Construction?

In a traditional insurance model, a general contractor is asking all subcontractors on the project to bring their own insurance. This means that all contractors on the project, both subs and the GC, are obtaining their own insurance coverage from wherever they choose.

Exploring the Benefits and Challenges of a Traditional Insurance Program

Benefits:

- Less direct responsibility of subcontractors and

- Less administrative work to get the program up and running, shared administrative responsibilities with the subcontractors on the project

- Traditional insurance programs are not project specific

- Typically lower deductible costs

- Typically realize less overall claims on the project

Challenges:

- Creates hostility between contractors due to liability lawsuits, litigation, and the legal process involved can create a major distraction or project disruption

- Claims can cause project delays

- A hard-market for insurance where some subcontractors are struggling to get any insurance

- Some subcontractors may not have inadequate coverage, or coverage lapses, leaving the GC/Owner on the hook

- Tracking all subcontractor insurance documentation can be difficult

Example of Legal Battles with a Traditional Insurance Approach

“For example, let’s say I get hurt on the job. I report this to my insurance carrier, but it’s actually the plumber’s fault that I got hurt. My insurance carrier then sues his insurance carrier. They, in turn, sue the insurance carrier of the guy that hired the plumber, who decides that it is the fault of the prime contractor, then the general contractor, then the owner. After all this, someone blames it on the guy who got hurt in the first place, me, and we’re back to square one. In a wrap-up the insurance carrier services your claim and gets you back to work.”

Examples of Projects Where a Traditional Insurance Model is Used

It is best to consult a risk manager before assessing whether to consider a Traditional vs. A Wrap-Up insurance program on your project.

The rule of thumb for determining whether to administer a wrap-up program typically looks at cost, amount of subcontractors, volume of workers, and general complexity (or risk potential) of the project. For example, a traditional insurance program may be used on a project that looks like this (see below):

Project Cost:

Less than $25,000,000

Subcontractor Volume:

Less than 20 Subcontractors

# of Workers:

Up to approximately 150 workers total on the project

Complexity Level (Risk Level):

Low

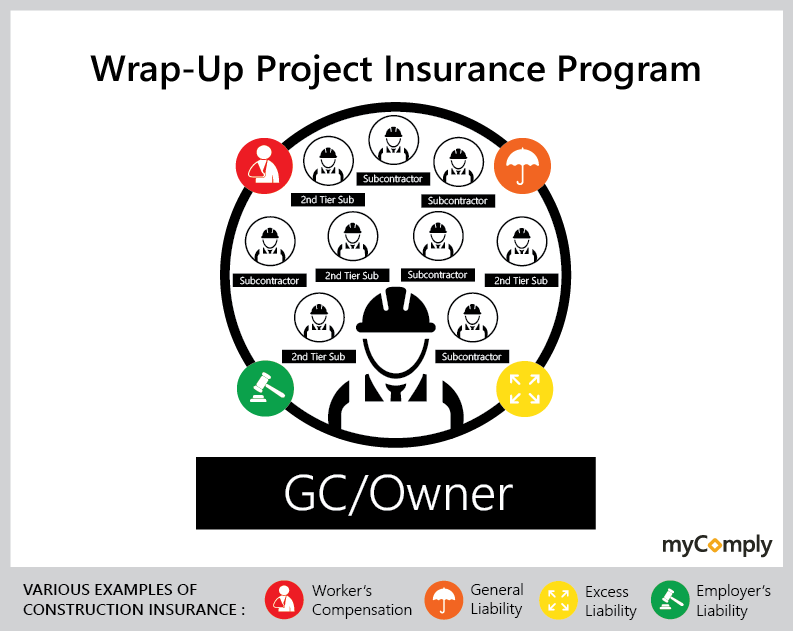

What is a Wrap-Up Insurance Program in Construction?

When a general contractor or owner is providing comprehensive coverage for all parties involved with the construction on a project, this is called a Wrap-Up insurance program, A.K.A a controlled insurance program (CIP).

This all-encompassing model is best suited for larger projects. Some sources suggest that the minimum project size by $100 million to plan and administer a wrap-up program, other sources show that a Wrap-Up program can be beneficial to projects starting at the $10M figure.

Bottom line is that this type of project insurance program is not likely going to be used on your local donut shop construction or even the construction of a small multi-family complex. Let us explore more!

When project Wrap-Up insurance is obtained and administered by the owner, it’s often referred to as an OCIP (Owner Controlled Insurance Program). When a insurance is administered by the general contractor, you’ll hear it referred to as a CCIP (Contractor Controlled Insurance Program).

OCIP vs. CCIP: What is the difference?

It is best to consult a risk manager before assessing whether to consider a Traditional vs. A Wrap-Up insurance program on your project.

The rule of thumb for determining whether to administer a wrap-up program typically looks at cost, amount of subcontractors, volume of workers, and general complexity (or risk potential) of the project. For example, a traditional insurance program may be used on a project that looks like this (see below):

Owner Controlled Insurance Program (OCIP):

- The project OWNER acts as a sponsor for the insurance coverage on the project and control the program. The OWNER is the first named insured and the general contractor, subcontractors, and any other parties on the project are named insureds.

Contractor Controlled Insurance Program (CCIP):

- The GENERAL CONTRACTOR sponsors and control the program. The GENERAL CONTRACTOR is the first name insured, and the subcontractors, plus any other parties are named insureds. Sometimes, the project owner is an additional insured or they share named insured responsibilities with the GC.

Exploring the Benefits and Challenges of a Wrap-Up Insurance Program

It is best to consult a risk manager before assessing whether to consider a Traditional vs. A Wrap-Up insurance program on your project.

The rule of thumb for determining whether to administer a wrap-up program typically looks at cost, amount of subcontractors, volume of workers, and general complexity (or risk potential) of the project. For example, a traditional insurance program may be used on a project that looks like this (see below):

Benefits:

- Cost savings on larger projects with volume discounts for the entire project instead of each subcontractor sourcing their own insurance and billing into the job cost

- Greater control over scope, limits of coverage, and less risk to insurance gaps on the project

- Higher limits, typically a controlled program allows for higher limits in the case of catastrophic incidents on-site

- Centralized management and facilitation

- Reduces disputes and minimizes hostility between parties working together on the project

- Less time spent in legal battles or the distractions of the litigation process

- Larger, high-profile project bids for contractors who may not have been in competitive standing for a bid without their Wrap-Up program

- Cost-savings are returned to overall profitability of the project

- Overall peace of mind and less worries or concerns about unknown coverages of external parties working on the project

Challenges:

- More claims as subcontractors are not directly paying the bill on claims

- Expensive to obtain, and contractors usually offset those costs by having higher deductibles

- GC/Owner inherits a lot of administrative responsibility on the project, rather than sharing admin responsibilities with subcontractors in the traditional approach

- Close coordination with insurance teams and underwriters to review requirements/responsibilities can be time consuming and stringent throughout the course of the project

- May need to hire independent consultant or “wrap-up administrator groups” to help oversee the management of the wrap-up program (I.e. professional groups such as C.R. Solutions)

- All responsibility can fall on 1 party’s (GC/Owner) shoulder, and that level of responsibility doesn’t appeal to all contractors.

- Limited to large projects, and won’t be worth the investment of time/effort for smaller projects with shorter project timelines

Example of Project Sizes Where a Wrap-Up Insurance Model is Used

A risk manager will typically look at cost, amount of subcontractors, volume of workers, and general complexity of the project to determine if wrap-up is going to provide benefits on your project. A Wrap-Up insurance program may be used on a project that looks like this (see below):

Project Cost:

More than $25,000,000, approximately

Subcontractor Volume:

20+ Subcontractors

# of Workers:

150+ workers total on the project

Complexity Level (Risk Level):

High

Why Technology Adoption is Important for Wrap-Up Insurance Programs

As mentioned previously, contractors and owners must work very closely with their insurers throughout a project where wrap-up is administered. The insurer wants transparency as to what is happening throughout a project, where timelines stand, any developments of concern, etc. Technology can play a significant role in carrying much of the administrative weight and offers data/information to anyone overseeing a project.

When reviewing a wrap-up model with your risk team, consider the technology you already use to help administer the program. Questions to be asked when considering the role of technology within a Wrap-Up Program:

- What data does my technology gather?

- What information does the technology I use provide to my insurer?

- What technology can I adopt to help offset some of the cost of the program?

- Will my insurance provider reward me with lower premiums if I am using a technology that is proven to reduce risk?

Not only will technology alleviate some of the administrative burden that comes with a Wrap-Up Program, but the technology itself can assist insurers and underwriters by providing crucial information about the project. Additionally, your insurance provider may recognize your technology selection as something that plays a role in reducing risk, which can impact your insurance premiums.

“Like an Alarm System for Your Home”

Key Takeaway: Be sure to ask your insurance provider about the technology you use, or are considering using, to reduce costly insurance premiums.

Traditional vs. Wrap-Up Insurance Program: Which model is for me?

The answer to that question is not as simple as you’d think, it’s completely depends on the scale of the project and the level of risk associated with the build. The best way to determine if a traditional model is better than a wrap-up model (and vice-versa) is to gain advisement from a risk professional.

Risk professionals not only help determine various levels of risk, but also have extensive experience helping contractors find insurance coverage, insurance savings, and the most importantly the RIGHT insurance program for the job at hand.

The Role of a Risk Manager or Risk Consultant

Risk managers are responsible for a variety of tasks in construction, and the job is extremely important for contractors working on large-scale infrastructure. It is important to note that many large construction companies have in-house risk teams, with risk managers working within their company. For many other contractors, this position is likely outsourced to a risk manager or risk management company that works as an independent consultant.

A risk manager, or independent risk consultant, looks to identify risks, reduce the number of incidents, prevent loss, and implement strategies to manage risk.

A Risk Manager:

- Advises contractors/owners on the purchase of insurance

- Manages project claims

- Works as an intermediary between project staff and insurance brokers/insurers/underwriters

- Monitors losses and budgets

- Identifies risk management strategies including the implementation of technology to reduce risk, increase safe practice, and save on insurance premiums

An effective risk manager will be able to help a contractor get the best possible rate for insurance and will constantly be looking for innovative solutions to help their organization (or client) lower their Experience Modification Rating (EMR), risk scores, and improve risk-related benchmarks.

Do Your Research and Ask a Risk Manager/Consultant for Help

A common misconception outside of the industry is that construction is a highly profitable undertaking. Although construction firms may operate on large-ticket jobs, the margins that contractors work with are quite small.

Small margins mean every line-item matter, and insurance savings can add significantly to a contractor’s bottom line. Questions you should ask yourself, or your team, or your risk manager:

- When is the last time I/we explored our insurance arrangements?

- Does the work we do qualify for Wrap-Up insurance?

- Would there be benefits to explore this?

- Have we talked about technology adoption with our risk consultant or risk manager to reduce insurance premiums?

Insurance is one of the largest costs for any contractor on a project, it’s time you consider all options for your insurance program. Be confident that you are getting the best coverage and consider technology adoption to reduce insurance premiums.

myComply Can Help Lower Insurance Costs

We work with over 5,000 contractors across the globe to help ensure a qualified workforce on every jobsite. myComply’s combination of easy-to-use software and intelligent hardware allows contractors to ensure everyone on-site is qualified to be there, and displays site information to users in real-time.

Get in touch if you’d like to learn more, or click the button to book a time to chat.